In 2008, Chinese auto parts companies felt unprecedented pressure, but after analyzing the status quo and problems of the parts and components industry, and the reasons behind the problems, we studied the problems the parts industry is currently facing, which is only the tip of the iceberg. If not, To fundamentally solve these problems, China's spare parts industry will disappear. The only solution is to implement a new "partial industry segmented development plan."

Impact of Economic Environment on Parts and Components Industry--Double Shrinkage of International and Domestic Markets

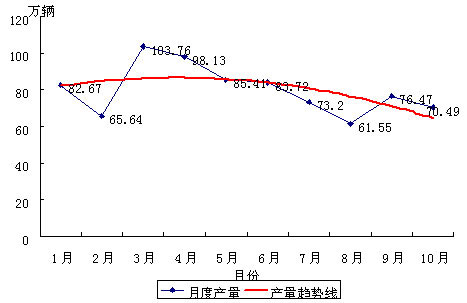

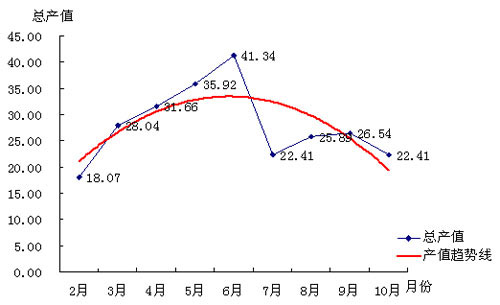

In 2008, the economic environment faced by China's auto parts industry was worse than ever. First of all, from the perspective of the international market, the continuous appreciation of the renminbi and the impact of the financial crisis have caused the export of parts and components to decline. This has made many parts and components industries that rely too heavily on foreign markets feel pressure to survive. When they wanted to transfer their bows to develop the domestic market, they found that those parts and components companies, which were mainly based in the domestic market, had a hard time. Since 2008, due to a variety of factors, China's vehicle market is showing a "W"-type development trend. The specific data and figures are shown in Figure 1. And the overall decline in sales volume, which directly reduces the demand for parts and components dropped significantly. A large number of factories stopped and half stopped. The double shrinkage of the international and domestic markets has led to an overall downward trend in the production of parts and components (specific trends and figures are shown in Figure 2). This has caused many parts and components companies to lose the courage and possibility of living.

Chart 1 Car Production Trends for January-October 2008

Chart 2 Trends in total auto parts production value from January to October in 2008

Impact of Policy Environment on Parts and Components Industry - China's Access to Technology May Be Blocked

On July 18, 2008, the expert group of the WTO Dispute Settlement Agency issued an expert group report to all WTO members. The results were in line with the February interim report, and it was determined that China had applied more than 60% of all imported parts and components to complete vehicles. The practice of taxes constitutes discrimination and violates trade rules. This means that the joint-venture vehicle company can legally import the basic assembly of the vehicle, as long as it pays 25% of the spare parts tariff. As a result, the price of imported cars will drop sharply, and the only advantage of domestic vehicle manufacturers will soon be lost. The enthusiasm for localization of spare parts for foreign-invested automakers will also be greatly reduced, and the long-awaited "technology spillover" of the Chinese people will become a month of water.

[next]

Industry Status--Infinite View of Foreign Capital, Double Failure of Domestic Capital

The infinite scenery of parts giants

According to the statistics of China's 7579 domestic auto parts enterprises in 2007, the profits of the foreign-funded enterprises are the best. The profit rate of the foreign-controlled enterprises' sales revenue is 8.2%, which is significantly higher than the 6.8% of the domestic private enterprises and that of the state-owned enterprises. 5.9%. Among the top 100 parts and components enterprises in 2007, there were 17 foreign-funded enterprises, a profit of 3.7 billion yuan, and a business income of 38.9 billion yuan. In the low-competitive, high-yield domestic OEM market, foreign-funded enterprises have also taken the absolute upper hand. For example, among the more than 130 domestic Tier 1 suppliers of Dongfeng Honda, there are only 30 purely Chinese-owned spare parts companies, and most of them are low-tech products. Correspondingly, it is the double failure of independent companies in the spare parts sector.

For example, recently, the big "DCT" plan was finally settled. The NDRC took the lead. BorgWarner provided technical equipment and contributed 66% of the funds. There are 12 companies (FAW, SAIC, Dongfeng, Chang'an, Chery, Brilliance, JAC, etc.) Changfeng, Geely, GAC, Zhongshun, Great Wall) jointly invested 34%, and the jointly formed BorgWarner Double Clutch Drive System Co., Ltd. settled in Dalian. The total investment of the joint venture company is 200 million U.S. dollars (1.38 billion yuan). The location of the joint venture company is located in Dalian Economic Development Zone. It is planned to be completed and put into use in early 2011. The joint venture will produce and develop the core products of the dual-clutch automatic transmission: the dual clutch module, the torsional vibration damper module and the control module, and will use BorgWarner's latest world-leading production technology.

This investment plan can be described as the biggest since BorgWarner entered the Chinese market in 1993 to establish Beijing Warner Gear Co., Ltd. BorgWarner currently has 370 employees in China and is second only to 400 in Asia after Asia. The company also claims that 15% of its profits come from Asia, and China has made a 1/3 contribution to its 15% profit. If you count the company’s headquarters in Shanghai and the new “DCT†project that was newly invested in this company, BorgWarner has seven subsidiaries in the country and all have absolute controlling rights. The expansion of BorgWarner's territory in China has entered a period of accelerated growth. The signing of this "DCT" will further boost its success in the Chinese market.

The Double Failure of the Market and Technology of China's Parts Enterprises

The research data of Hong Rui Xinsi shows that foreign-funded enterprises already occupy more than 60% of the market share in China's auto parts market. The market share of foreign-funded companies in the car parts market is close to 80%, while in high-tech areas such as automotive electronics and engine parts, the market share is as high as 90%. After China's foreign-owned enterprises have eaten up, the rest of the auto parts companies is only left unrecognisable, stifling a market share of less than 40%.

If we use foreign technology in exchange for a market like the entire vehicle, we can also think that such joint ventures and open markets are successful. However, the fact is that at the time of the loss of the market, the level of technology has not only failed to progress, but the gap with the advanced level in foreign countries has further widened. At present, foreign-funded enterprises have formed monopolies in key engine technologies such as high-pressure common rails. In addition, in the areas of automatic car transmissions, ABS anti-lock braking systems and automotive electronics technology, core technologies have also been controlled by foreign companies, and key components still rely on imports. There has been no breakthrough in domestic research.

The financial crisis hit more pressure on some of the most powerful parts and components companies. For example, Hua Xiang's "extension" and Weichai's "lending of debts" all underscore the tight funding and financial constraints of the crisis.

Ningbo Huaxiang (002048) announced on November 28 that the “New Auto Parts R&D Center Project†was a non-public issuance fund raising project for the company in 2006. It was originally planned to be implemented by Ningbo Huaxiang in Ningbo Jiangbei, with a total investment of 3650. Ten thousand yuan, the construction period is one year, and the construction plan has been postponed. It was decided by the company's research that the project will be implemented by Ningbo Huaxiang Auto Parts R&D Co., Ltd., a wholly-owned subsidiary to be formed.

The Ningbo Huaxiang Auto Parts R&D Co., Ltd. to be established is a wholly-owned subsidiary established by Ningbo Huaxiang with a raised capital of 36.5 million yuan. The registered capital of the new company is 10 million yuan.

On the same day, Weichai Power also issued an announcement that the company intends to apply for public issuance of medium-term notes in the national interbank bond market. The proposed issuance size is not more than RMB 2.7 billion and the proposed issuance period is five years. The issuance interest rate is determined by the market pricing. Underwritten by China Merchants Bank, the issuance method is the balance underwriting, and the redemption method is annual interest and expired. The funds to be raised will be used to supplement the company's interim liquidity, repay the company's borrowings, improve the company's debt structure, and other expenses permitted by the provisions of the medium-term notes.

The company also announced that it has entered into daily related-party transaction agreements or supplementary agreements with related parties. It is expected that the total amount of continuing connected transactions of the company's headquarters in 2008, 2009, and 2010 will be approximately RMB 2.2 billion, RMB 3.8 billion, and RMB 4.5 billion respectively. The total amount of continuing related party transactions of other subsidiaries in 2008, 2009, and 2010 are capped at approximately 3.8 billion yuan, 4.6 billion yuan, and 5.5 billion yuan respectively.

Huaxiang changed the project implementation entity and postponed the project. Weichai issued mid-term bills to repay liquidity funds to repay the loans. There wasn't much related action originally. When this crisis struck, it was not so simple. With the tightening of the capital chain, the two major listed companies have also begun to rely on shrinking investment and increasing their debt to spend time.

[next]

The analysis of the status quo of the status quo - Parts companies, governments, upstream and downstream are reluctant to resign

The problems of parts and components companies are mainly reflected in four aspects: quality instability, lack of timely delivery of technology, and lack of experience in dealing with crises. This leads to its market competitiveness and adaptability is not strong, only to allow people to bully. The problems of the government are mainly manifested in the deviation of policies and the release of restrictions on the ratio of shares. The specific equity ratio analysis is shown in the table below. Strong foreign investment entered China's spare parts market with almost no obstacles. At that time, the strength of domestic parts and components companies was rather weak and they could not compete with them. As a result, foreign capital has formed an absolute controlling position in the domestic spare parts industry in a short period of 30 years. This is like a big mountain, firmly squeezing domestic parts and components companies at the bottom of the market. This is also a deep-seated factor in the development of abnormalities in parts and components compared with the entire vehicle industry. Upstream and downstream companies such as upstream steel mills and downstream OEMs rely on their own monopoly and strength to squeeze the profit margins of parts and components companies, making it difficult for parts and components companies to survive and grow.

Chart 4 Share Proportion Analysis of Parts and Components Industry

Sub-component development planning for parts and components industry - the only way for the spare parts industry to survive and grow

As far as the entire auto parts industry is concerned, the market share of China's autonomous parts and components companies and the manufacturing capacity of 90% are concentrated in the low-end parts and components products, while only 10% of the companies are taking the high-end route and the production has higher technology content. The parts and components are the top 10%, and the vast majority are also joint ventures with foreign companies. If this trend continues, China's parts and components companies will be completely squeezed into the low end of the range, and they will never be developed. According to the research of Beijing Hong Ruixinsi, there may be hope for the development of parts and components industry to follow the "divided development plan." Of course, the implementation of this plan needs the cooperation of all parties and it needs to be relatively long. For some time, but it can make the parts and components companies really grow up, this cost is worth it.

First of all, for 10% of high-end products, you can choose to gradually abandon the joint venture. At the same time, the funds and manpower drawn from the joint venture will be put into the establishment of research institutions and university laboratories, and the road to R&D will be truly started. Because on the road of R&D, we can only rely on ourselves and the foreign side cannot rely on it. The 30-year joint venture experience has also proved this point. When these high-end technologies have become domestically produced, they will continue to focus on the high-end products of the parts and components industry and allow high-end products to become the leading products in the parts and components industry. This is also a thick and thick process.

For 90% of the low-end products, they are divided into different grades to arrange different development directions. Some powerful companies have begun to move toward mid-range products. This proportion may start at only 5%. However, it is necessary to continuously guide and select powerful parts and components companies to make progress, and gradually expand the market share and production capacity of this region. However, there is a limit to the development of the mid-market, for example, only to 35%. Second-rate parts and components companies still insist on doing low-end products, but the company's strength must be gradually improved, and then switch to mid-range products, compress the market share of low-end products, compressed to 5% or even completely eliminated. The increase in the strength of the second- and second-tier companies is also accompanied by the acquisition and merger of third-rate companies.

The final blueprint for development is that high-end products burst through and become the dominant products. The remaining market share is mid-range products, while the low-end products are transferred to other underdeveloped regions and countries. The specific plan can be represented by the following figure:

Film Evaporator,Scraper Thin Film Evaporator,Scraper Film Evaporator,Automatic Customized Film Evaporator

Wuxi Zhanghua Pharmaceutical Equipment Co. Ltd , https://www.wxzhanghua.com